Budget Talks

Budget talks.

The other day we discussed our tax levy. There are so many parts to an Ontario Municipal budget to understand. Today let’s talk about the fact that all budgets in municipalities in Ontario need to be balanced budgets. By this, it means that the total income and total expenditures should be about equal. We will also discuss the MPAC deception.

On the income side of things, the levy is the amount of money required from taxpayers in the community to make up the shortfalls in the budget from other sources of income. These sources may be user fees, or transfer payments from other levels of government, development charges, use of reserves, etc…

The bottom line is this… Expenditures decided upon by YOUR council are what determines your municipal tax bill.

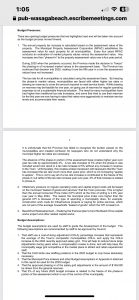

In a recent “Budget Assumptions” document, provided to and accepted by our Council, there was a big glaring written comment about the MPAC rates being frozen for these last few years. Normally these rates are adjusted every four years. Our Council wants you to believe this has an impact on the individual total taxes we all pay.

In a recent “Budget Assumptions” document, provided to and accepted by our Council, there was a big glaring written comment about the MPAC rates being frozen for these last few years. Normally these rates are adjusted every four years. Our Council wants you to believe this has an impact on the individual total taxes we all pay.Although it may be true regarding how much I pay compared to my neighbour, it has NOTHING to do with the total tax collected. It’s time for our Municipal leaders to lead.

When a report needs clarification, it is the responsibility of our Mayor and elected body to provide both the questioning of that report and guidance in seeking the answers.

I guess, if they don’t understand the issue, it’s difficult to intervene. I want to point out that at this same Council meeting where they took zero minutes to discuss this budget document, they went on and on (during the recreation update) about how some parents were not doing a good job disciplining their children near Stonebridge. Bizarre! People… I simply CANNOT make this stuff up. If you choose to watch the meeting you will see it is all there.

Attached, I have included a page of the report they accepted. Please read it and tell me if it sounds like they are preparing to blame MPAC for what I suspect will be another tax increase.

This whole concept of “MPAC assessments not being up to date”, affecting the overall municipal budget, is ludicrous.

Our costs to operate, maintain and grow our community are decided by our Council. At the end of the day, all departments say they need x dollars to operate their division. The Council approves that amount of spending and then they divide that total over the entire tax base of our community.

There are all kinds of resources available to help our elected officials understand this concept, but if they can lay the blame at the feet of someone else for a tax increase, they have proven- that will be their chosen path.

When considering the impact MPAC assermentés have on our taxes, you could even revert to MPAC assessment rates from 1990 and it would not change the tax we all pay collectively at the end of the day this year.

What might create change is this….

Say the entire community had 1000 identical properties. Each of those properties paid their equal percentage of the required taxes. If 500 of those properties improved their property value by building an attached garage, it would be possible that now, you would have 500 properties worth a larger percentage of the total tax and 500 properties worth a lesser percentage of the total tax.

The Association of Municipalities of Ontario has great resources to explain this. (See attached video)

Both the pre-garage construction homes and the post-construction homes have not changed the total required by the town to operate.

So…. The TOTAL tax only increases if your Council decides it needs more money to operate your community. If for instance, they choose to lend $500,000.00 to start a concert promotion company, all homeowners would pay their portion of that.

So…. As the next few months unfold and Mayor Smith foreshadows all of the various reasons our Council will have to raise taxes, remember: The total expenditures of WASAGA Beach (in 2025) are what matters. Spending on parties, concerts, new hires, construction, maintenance, unnecessary bank fees, wage increases, advertising, signs, , Facebook adds…. THESE are what make your taxes go up or down.

Don’t be led to look at too many outside sources. Look at OUR budget.

MPAC updates would possibly modify what you and your neighbour might pay as a percentage of the total needed budget, but COUNCIL decides on that total number! No more passing the buck. Be responsible! This could/ should be a year of zero tax increases or even a rollback. But spending would have to be cut very sharply.

Instead, I suspect they will try to minimize the perceived impact of their out of control spending. There are certainly a couple of ways to do that. Remember, we started by saying we are required to have a balanced budget.

Expenditures go up? Well then the income side has to go up as well.

My guess is they will offset their spending by selling off assets and/ or utilizing reserves like never before!

What may have seemed like simple housekeeping months ago, when Council declared so many municipal properties surplus (the first step in selling these) , is now easy to understand as a possible income stream. If the Council can sell off municipal parking lots (like Dunkeron or Main Street or Beach One), then those funds can offset the immediate impact of taxation.

Another way to balance the budget would be by pulling from reserves. THIS is a very complicated issue worthy of a separate discussion. Suffice it to say, it is a good thing that there are strict rules regarding the use of some of these obligatory reserves.

So, take the time to FULLY understand the claims made by our Council. To say something is true is different than saying it is entirely true. Listen carefully… seek the entire truth.

please scroll down for comments

(I moved it).